Similar to with any repeating costs, you need to pay your auto insurance premium routinely or your insurance provider will quit offering insurance coverage. Unlike a missed phone bill, the repercussions of missing out on an insurance settlement can be far-reaching. After a cancellation for a missed repayment, the insurance provider can raise your rates and your certificate may be withdrawed - insurance.

It's crucial that you contact your insurance provider as quickly as you understand you lag on your insurance payments. cheapest auto insurance. What to do if you can't afford or miss out on an auto insurance policy settlement As soon as you realize you will likely miss out on or have already missed an auto insurance repayment, call your insurance provider to allow them understand you recognize the circumstance as well as ask what you can do following.

If you've missed payment by a few days If you have actually just missed the payment by a couple of days to a week, you likely can restore your plan without a gap in coverage or various other severe effects, as you're still in the grace duration - prices. You'll have to pay the quantity you missed, normally with a late payment cost.

It's illegal to drive without insurance coverage in nearly every state, so when your insurance is ended, you will not be able to drive. After you have insurance once more, you need to call your state's department of motor vehicles to upgrade your insurance coverage information and also confirm that your enrollment and driver's permit are still legitimate.

It may at some point pass any kind of past due financial debts to a debt collection agency. What happens when your cars and truck insurance coverage is terminated for missing a payment? If you miss out on an auto insurance repayment, you'll get a legitimately needed notice of cancellation from your insurance provider - cheapest car insurance. This notice might can be found in the mail or by a phone call or e-mail.

The exact amount of time varies by state. Afterwards, your insurance policy will formally lapse and also you'll no much longer be able to drive your automobile lawfully. In some states, allowing your insurance coverage gap additionally nullifies your enrollment either right away or a few weeks after your insurance policy lapses. No issue where you live, the longer you wait before remedying the trouble, the better the consequences will be.

More About What Happens After A Late Car Insurance Payment?

Long-term repercussions of terminated insurance policy because of missed out on repayments If your vehicle insurance policy gaps or is terminated, whether it's due to the fact that of nonpayment or any type of other factor, you will likely deal with financial ramifications of some kind. The repercussions can proceed also after you have actually renewed your insurance coverage. Right here are some feasible end results of missing your cars and truck insurance policy repayments.

For example, in New york city, motorists have to pay $8 per day for as much as thirty days during which their insurance coverage was lapsed, with increased fines thereafter.: Nearly every state needs chauffeurs to insure their cars in order to register them, and many states call for insurer to notify them if you allow your insurance coverage lapse.

You might even be called for to bring an if you are captured driving while without insurance, particularly if you create an accident (vehicle insurance).: Insurance provider like to see that chauffeurs can reliably pay their bills on time each month. Individuals that allow their insurance coverage gap, even for a short amount of time, will likely see an increase in car insurance costs the next time they renew.

cheapest auto insurance insured car car insurance cheap car

cheapest auto insurance insured car car insurance cheap car

If your cars and truck lender discovers you are not carrying insurance coverage on the automobile, it might retrieve the car.: If you owe cash on your car insurance coverage and also your insurer passes the financial obligation to a debt collection agency, it will likely influence your credit history score - cheapest auto insurance. This can affect your capacity to get a charge card or loan, and also the negative mark will stay on your credit report for up to 7 years.

You will most likely be billed a late repayment fee. If your payment is behind the elegance period permits, your insurance can lapse. The length of time is the poise period prior to your insurance plan gaps? The moratorium for late settlements prior to your policy lapses differs by insurer as well as by state.

It is really crucial to recognize the moratorium for your plan and to call your insurance company if you anticipate to make a late repayment (laws). Just how can you restore canceled automobile insurance coverage? When your car insurance is canceled, the first thing you ought to do is call your current insurance company. If your plan has only lapsed for a couple days, it's possible they can restore it.

The smart Trick of § 38.2-231. Notice Of Cancellation, Refusal To Renew, Reduction ... That Nobody is Talking About

, and also instantly you get a letter, email or a phone call informing you that your plan will certainly be canceled for non-payment. Can An Insurance Policy Company Cancel You For Non-Payment?!? Occasionally people forget the repayment due date or have actually something come up that quit them from taking treatment of service.

Cancellation for non-payment is possibly a great deal more typical than you think. As soon as you find out it, you need to contact your insurance coverage firm or representative right away.

In a worst-case circumstance, be prepared to pay the full amount due prior to your plan gets canceled so that they may restore it. Insurance coverage firms are generally prepared to work something out if you inform them what is going on.

Always call the business to see to it what the treatment is to terminate and let them know your intent. Never allow a plan to be canceled for non-payment just because you don't require the insurance anymore. Insurance provider might do soft-credit look at your credit rating as well as they additionally think about if you have been canceled for non-payment before.

They may let you request a termination and also quit the non-payment. In some conditions, if you did insure yourself somewhere else, you may ask your new agent to aid you out by sending proof of your new insurance policy to the old insurance policy agent, along with a note claiming that the policy is "not needed" and you have guaranteed on your own in other places - business insurance.

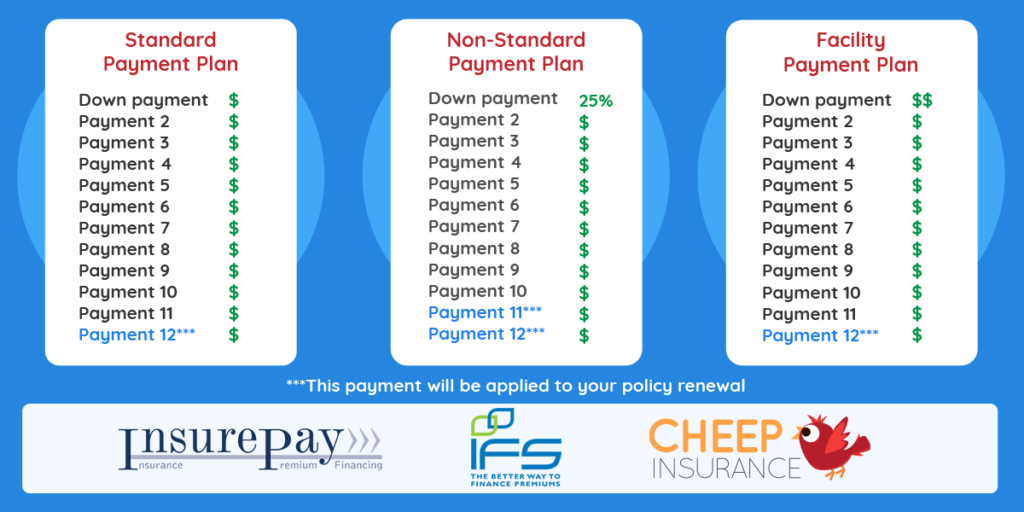

In either of these cases, offer them a telephone call and also obtain it fixed or it will certainly be an unfavorable on your insurance policy background and might stop you from obtaining insurance policy or receiving settlement strategies in the future. When Would an Insurer Cancel Me for Non-Payment? An insurance provider supplies you with the regards to a payment arrangement when you register for your plan (laws).

The smart Trick of Non-payment And Insurance Cancellation Affect Insurance Rates That Nobody is Talking About

cheap auto insurance insurance money suvs

cheap auto insurance insurance money suvs

Your settlement plan contract should detail the certain details of exactly how this would certainly be handled. Numerous business, as an example, will enable mercy if you have one NSF repayment, perhaps two, but after repeated cases, they generally schedule the right to terminate you for non-payment, despite the number of settlements have been made prior to the case.

cheap insurance insurance company cheap car insurance suvs

cheap insurance insurance company cheap car insurance suvs

The top means to avoid being terminated for non-payment is to connect with your insurance policy representative and also make repayment arrangements. Make sure you pick a settlement strategy, and repayment regularity you can work with when you established up your brand-new insurance policy and if it does not function for you when points alter in your life, you can call the firm and ask to take a brand-new strategy - cheapest car.

Many of the moment they will certainly function with you to get your policy restored as well as placed you back on course. Call them and also try as well as make a plan, the consequences of being canceled for non-payment are major in the insurance globe, as well as you might have a tough time locating reasonably valued insurance after you have a termination on data - cheap auto insurance.

Keep in mind, if you are having trouble paying your insurance policy, you are additionally mosting likely to have a really tough time spending for damages if you have a loss and your insurance is canceled. Even more than ever before, when you remain in monetary difficulty, your insurance policy is the last thing you intend to lose.

Understanding Termination for Non-Payment of Plan Impact This write-up is a standard to aid you understand just how termination for non-payment collaborate with an insurance provider. Considering that Insurance is controlled on a local level, every state as well as province will certainly have different requirements. Likewise, every insurance provider has various settlement policies. This info is to be made use of as a general overview to help you obtain things back on track, yet in no method replaces the actual rules, guidelines or constraints of your specific plan.

Greet to Jerry, your new insurance agent. We'll contact your insurance policy company, review your existing plan, then find the insurance coverage that fits your demands and saves you cash - cheap car insurance.

The 6-Minute Rule for Car Insurance Cancellation For Non-payment - Michigan Auto ...

Although you recognize that it is very important to have lorry insurance coverage, you may not understand just how serious the consequences can be if you allow your plan to gap (dui). Figure out what takes place if auto insurance is canceled and also why insurance provider may pick to do so. Why Would an Insurer Terminate a Plan? Bankrate advises that an insurance company can cancel your policy if you don't follow the terms and conditions as stated in the policy arrangement.

Cancelation Based on Nonpayment of Costs, Although losing one's plan because of nonpayment might look like an approximate factor, it's really one of one of the most usual reasons for policy cancelations. The reasons people miss insurance repayments are differed. Occasionally, individuals come to be so caught up in their hectic lives that they merely neglect to pay their premiums.

No matter the reason, Nerd, Purse mentions that the biggest mistake individuals make is to neglect notices and not do something about it as quickly as they drop behind in repayments - insurers. The finest course of action is to call your insurance provider immediately and also chat with a depictive regarding the steps you can require to try to save your plan.

liability cheaper car insurance cheapest car insurance cheap

liability cheaper car insurance cheapest car insurance cheap

To locate out regarding certain details in this respect, you ought to consult your policy contract. What Occurs When Your Plan Is Terminated? When you have actually failed on an insurance costs, your insurance provider will send you a notice that your plan will certainly be terminated if you don't make a payment.

Depending on the state where you live, losing your insurance plan will result in a loss of your automobile registration. No matter of the state you live in, however, you need to take action as soon as feasible, as the troubles you deal with without an insurance policy will just come to be worse over time.

1. PenaltiesIn some states, vehicle drivers whose insurance plans have actually lapsed are fined. In New york city, as Check out this site an example, not having a plan will certainly cost you $8 daily for the very first 30 days, after which the fines will boost. 2. Suspension of Vehicle Certificate And/Or Registration, In the majority of states, it's a legal need to obtain insurance coverage before you can register your vehicle.

Some Known Factual Statements About What Happens If Car Insurance Lapses? - The Hartford

Poor Credit History Ranking, Some insurance coverage business might choose to pass you on to a collection company when you default on your repayments. insurance. Aside from the aggravation of regularly being troubled for payment, debt at a debt collection agency may also have a negative impact on your credit report. An inadequate credit scores ranking, subsequently, will certainly hamper your capacity to protect a financing, obtain a charge card, as well as buy or rent a home or a vehicle.